Earlier in the post What is Marketing Research I discussed the basics related to Business Market Research, now in this segment let’s have a look at the concepts that one should be clear with if you want to make your career as a Market Research Analyst.

1. SWOT is basically a business tool that deals with the internal and external factors of the business. A SWOT analysis can be done by a single person or a group of people. Both cases involve performing only a few steps.

Synthesis of the internal data to list the weaknesses and the strengths of the firm

Collecting external data to identify possible threats and opportunities.

Strengths: It describes the positive factors of your business. These are completely under your control, and you decide how to utilize them for the benefit of your company. Strengths are considered as an internal factor and include the positive attributes of your company. It can be classified based on the area of expertise. Like your company has a strong finance sector or a brilliant marketing team, highly skilled workers who have been given adequate training then they are also considered as your strength.

Weaknesses: These are internal factors that are within your control. Despite being in your control, these factors somewhat stop you from performing at an optimum level. These will hinder your progress and give a competitive edge to your competitors.

Weaknesses may include the lack of technologies, lack of capital invested in your business, unskilled labors, or even the poor location of your business. These factors are in your control but need improvements so that you are no longer at a disadvantage. A key part of analyzing the weakness is to come up with ideas that will not only improve your weaknesses but also match up with the competitors.

Opportunities: Here now let’s move to the external factors. External forces are such that are beyond your control. However, opportunities are positive external factors. Opportunities reflect the potential of the business and marketing strategy implemented. These open up the possibilities for the business to do well. If done right or taken advantage of them the business will have a significant boost over its rivals or competitors.

Opportunities may arise due to certain reasons. For instance, a change in consumer demand or taste can be an opportunity. Weather factors, economic conditions are also termed as opportunities. Government subsidizing certain firms can be classified as an opportunity if your business falls under those certain firms. Sometimes opportunities may be such that fall under your internal factors. For example, say all firms which are eco-friendly will have a deducted income tax. If your company happens to be an eco-friendly firm, then you can take this opportunity and classify it as strength as well.

Threats: These are basically the factors that may put your marketing strategy in danger of loss. Not only that, but your entire business is also at risk as well. A key part of SWOT analysis is the assessments of the possible threats that may arise. Since it is an external factor, you have no control over it. However, you can make a contingency plan to combat such risks. Threats can be of different kinds. If you are in the agriculture industry, then bad weather may be termed as a threat. On the other hand, if you are in the importing business, then government tax regulations are seen as a threat. Other threats can be raising prices from suppliers, pressure from the activist groups (Social Factor), bad media coverage, or even lawsuits that are likely to damage the company’s reputation. Even your competitors are your threats. Their improvements will provide competition for your product. You cannot stop them from doing well. But you can use your strengths to outperform them.

Threat of substitute products or services: The existence of products outside the area of the common product boundaries increases the propensity of customers to switch to alternatives. For example, tap water might be considered a substitute for Coke, whereas Pepsi is a competitor’s similar product. Increased marketing for drinking tap water might decrease the profit for both Coke and Pepsi, whereas increased Pepsi advertising would likely “grow the profit” (increase consumption of all soft drinks). Another example is the substitute for a landline phone with a cellular phone.

Bargaining power of customers (buyers): The bargaining power of customers is also described as the market of outputs: the ability of customers to put the firm under pressure, which also affects the customer’s sensitivity to price changes. Firms can take measures to reduce buyer power, such as implementing a loyalty program. The buyer power is high if the buyer has many alternatives. The buyer power is low if they act independently e.g. if a large number of customers will act with each other and ask to make prices low the company will have no other choice because of a large number of customers pressure.

Bargaining power of suppliers: The bargaining power of suppliers is also described as the market of inputs. Suppliers of raw materials, components, labor, and services (such as expertise) to the firm can be a source of power over the firm when there are few substitutes. If you are making cookies and there is only one person who sells flour, you have no alternative but to buy it from them. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

Intensity of competitive rivalry: For most industries, the intensity of competitive rivalry is the major determinant of the competitiveness of the industry because of innovation, Competition between online and offline companies, Advertising expense, Degree of transparency.

3. PESTLE Analysis, is sometimes referred to as PEST analysis, is a concept in marketing principles. Moreover, this concept is used as a tool by companies to track the environment they’re operating in or are planning to launch a new project/product/service, etc.

PESTLE expanded as Political, Economic, Social, Technological, Legal, and Environmental. PESTLE analysis is a more comprehensive version of the SWOT analysis.

Political: These factors determine the extent to which a government may influence the economy or a certain industry. For example, a government may impose a new tax or duty due to which entire revenue generating structures of organizations might change. Political factors include tax policies, Fiscal policy, trade tariffs, etc. that a government may levy around the fiscal year and it may affect the business environment (economic environment) to a great extent.

Economic: These factors are determinants of an economy’s performance that directly impacts a company and have resonating long term effects. For example, a rise in the inflation rate of any economy would affect the way companies price their products and services. Adding to that, it would affect the purchasing power of a consumer and change demand/supply models for that economy. Economic factors include inflation rate, interest rates, foreign exchange rates, economic growth patterns, etc. It also accounts for the FDI (foreign direct investment) depending on certain specific industries who’re undergoing this analysis.

Social: These factors scrutinize the social environment of the market, and gauge determinants like cultural trends, demographics, population analytic’s, etc. An example of this can be buying trends for Western countries like the US where there is high demand during the Holiday season.

Technological: These factors pertain to innovations in technology that may affect the operations of the industry and the market favorably or unfavorably. This refers to automation, research and development and the amount of technological awareness that a market possesses.

Legal: These factors have both external and internal sides. There are certain laws that affect the business environment in a certain country while there are certain policies that companies maintain for themselves. The legal analysis takes into account both of these angles and then charts out the strategies in light of these legislations. For example, consumer laws, safety standards, labor laws, etc.

Environmental: These factors include all those that influence or are determined by the surrounding environment. This aspect of the PESTLE is crucial for certain industries particularly for example tourism, farming, agriculture, etc. Factors of a business environmental analysis include but are not limited to climate, weather, geographical location, global changes in climate, environmental offsets, etc.

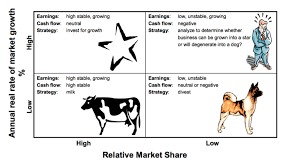

Dogs- Dogs have low market share and a low growth rate and thus neither generate nor consume a large amount of cash. However, dogs are cash traps because of the money tied up in a business that has little potential. Such businesses are candidates for divestiture.

Question marks – Question marks are growing rapidly and thus consume large amounts of cash, but because they have low market shares they do not generate much cash. The result is a large net cash consumption. A question mark (also known as a “problem child”) has the potential to gain market share and become a star, and eventually a cash cow when the market growth slows. If the question mark does not succeed in becoming the market leader, then after perhaps years of cash consumption it will degenerate into a dog when the market growth declines. Question marks must be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

Stars- Stars generate large amounts of cash because of their strong relative market share, but also consume large amounts of cash because of their high growth rate; therefore the cash in each direction approximately nets out. If a star can maintain its large market share, it will become a cash cow when the market growth rate declines. The portfolio of a diversified company always should have stars that will become the next cash cows and ensure future cash generation.

Cash cows- As leaders in a mature market, cash cows exhibit a return on assets that is greater than the market growth rate, and thus generate more cash than they consume. Such business units should be “milked”, extracting the profits and investing as little cash as possible. Cash cows provide the cash required to turn question marks into market leaders, to cover the administrative costs of the company, to fund research and development, to service the corporate debt, and to pay dividends to shareholders. Because the cash cow generates a relatively stable cash flow, its value can be determined with reasonable accuracy by calculating the present value of its cash stream using a discounted cash flow analysis.

• The GE matrix generalizes the axes as “Industry Attractiveness” and “Business Unit Strength” whereas the BCG matrix uses the market growth rate as a proxy for industry attractiveness and relative market share as a proxy for the strength of the business unit.

• The GE matrix has nine cells vs. four cells in the BCG matrix.

Industry attractiveness and business unit strength are calculated by first identifying criteria for each, determining the value of each parameter in the criteria, and multiplying that value by a weighting factor. The result is a quantitative measure of industry attractiveness and the business unit’s relative performance in that industry.

Industry Attractiveness: The vertical axis of the GE / McKinsey matrix is industry attractiveness, which is determined by factors such as the following:

• Market growth rate

• Market size

• Demand variability

• Industry profitability

• Industry rivalry

• Global opportunities

• Macro-environmental factors (PESTL/ PEST)

Each factor is assigned a weighting that is appropriate for the industry. The industry attractiveness then is calculated as follows:

Business Unit Strength: The horizontal axis of the GE / McKinsey matrix is the strength of the business unit. Some factors that can be used to determine business unit strength include:

• Market share

• Growth in market share

• Brand equity

• Distribution channel access

• Production capacity

• Profit margins relative to competitors

Strategic Implications

Resource allocation recommendations can be made to grow, hold, or harvest a strategic business unit based on its position on the matrix as follows:

• Grow strong business units in attractive industries, average business units in attractive industries, and strong business units in average industries.

• Hold average businesses in average industries, strong businesses in weak industries, and weak business in attractive industries.

• Harvest weak business units in unattractive industries, average business units in unattractive industries, and weak business units in average industries.

There are strategy variations within these three groups.

For example, within the harvest group, the firm would be inclined to quickly divest itself of a weak business in an unattractive industry, whereas it might perform a phased harvest of an average business unit in the same industry.

While the GE business screen represents an improvement over the simpler BCG growth-share matrix, it still presents a somewhat limited view by not considering interactions among the business units and by neglecting to address the core competencies leading to value creation. Rather than serving as the primary tool for resource allocation, portfolio matrices are better suited to displaying a quick synopsis of the strategic business units. For making it easier to understand the example of Maruti Suzuki business is taken to have a look.

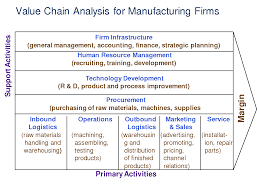

6. Value Chain Analysis is a set of activities that a firm operating in a specific industry performs in order to deliver a valuable product or service for the market. The idea of the value chain is based on the process view of organizations, the idea of seeing a manufacturing (or service) organization as a system, made up of subsystems each with inputs, transformation processes, and outputs. Inputs, transformation processes, and outputs involve the acquisition and consumption of resources – money, labor, materials, equipment, buildings, land, administration, and management. How value chain activities are carried out determines costs and affects profits. In Porter’s value chains, Inbound Logistics, Operations, Outbound Logistics, Marketing and Sales, and Service are categorized as primary activities. Secondary activities include Procurement, Human Resource Management, Technological Development, and Infrastructure. The appropriate level for constructing a value chain is in the business unit and not division or corporate level. Products pass through a chain of activities in order, and at each activity, the product gains some value. The chain of activities gives the products more added value than the sum of added values of all activities.

A firm’s value chain forms a part of a larger stream of activities, which is called a value system. A value system, or an industry value chain, includes the suppliers that provide the inputs necessary to the firm along with their value chains. After the firm creates products, these products pass through the value chains of distributors (which also have their own value chains), all the way to the customers. All parts of these chains are included in the value system. To achieve and sustain a competitive advantage, and to support that advantage with information technologies, a firm must understand every component of this value system.

Primary Activities

Inbound Logistics/ Upstream: arranging the inbound movement of materials, parts, and/or finished inventory from suppliers to manufacturing or assembly plants, warehouses, or retail stores.

Operations: concerned with managing the process that converts inputs (in the forms of raw materials, labor, and energy) into outputs (in the form of goods and/or services).

Outbound Logistics/ Downstream: is the process related to the storage and movement of the final product and the related information flows from the end of the production line to the end-user.

Marketing and Sales: selling a product or service and processes for creating, communicating, delivering, and exchanging offerings that have value for customers, clients, partners, and society at large.

Service: includes all the activities required to keep the product/service working effectively for the buyer after it is sold and delivered.

Support Activities

Procurement: the acquisition of goods, services or works from an outside external source

Human Resources Management: consists of all activities involved in recruiting, hiring, training, developing, compensating, and (if necessary) dismissing or laying off personnel.

Technological Development: pertains to the equipment, hardware, software, procedures, and technical knowledge brought to bear in the firm’s transformation of inputs into outputs.

Infrastructure: consists of activities such as accounting, legal, finance, control, public relations, quality assurance, and general (strategic) management.

Few Others Includes of:

- 4 Corners

- War Gaming

- Early Warning System involves monitoring the whole system continuously in order to find out the budding problem at the initial stages.

Basically there are other tools also that can be used. Among all the few mentioned above are the most used ones. If you think there are tools that should be mentioned in the list then do comment below, it would be appreciated.